Does Home Insurance Cover Boiler Breakdown?

Table of Contents

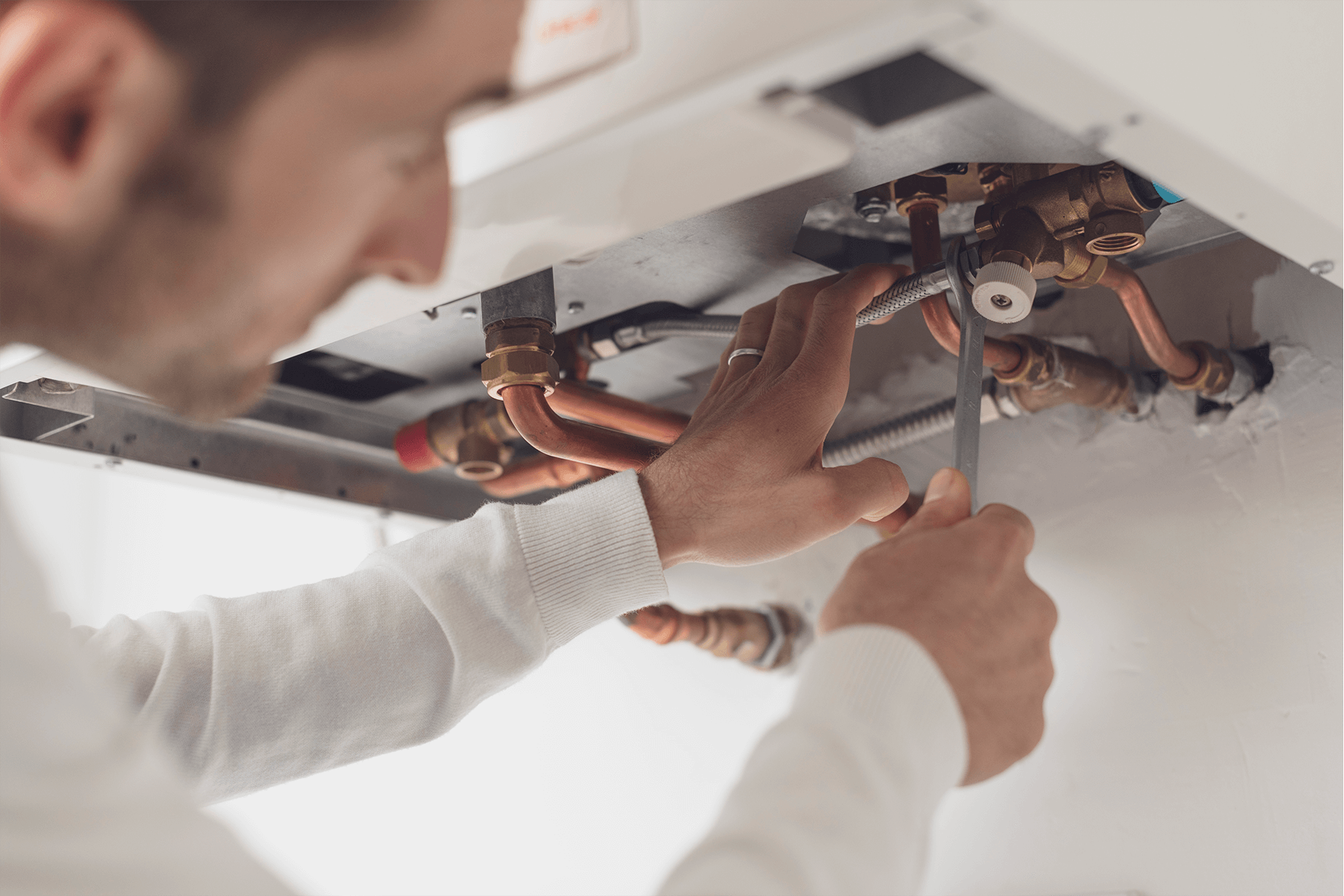

Your boiler is one of the most important appliances in your home, as it supplies you with heat and hot water when you need it.

Unfortunately, boilers can have issues from time to time, especially if they are older.

People often ask, “Does home insurance cover boiler breakdown?” Most of the time, it does not.

It is common for boilers to break down from a lack of servicing or proper maintenance, so home insurance companies are hesitant to cover them. But, if damage occurs to your property due to a broken boiler, then it is often covered by your home insurance policy.

In some cases, you may be able to take out extra cover for boiler breakdown, and it usually goes by the name of boiler cover or emergency home cover.

This article aims to answer the question, “Are boilers covered by home insurance?”

What Home Insurance Covers When Your Boiler Breaks Down

Boiler breakdown is quite common, and it often happens due to poor maintenance or servicing. Unfortunately, most home insurance companies do not cover it as part of your home insurance cover.

However, they will usually cover damages that occur as a result of the boiler breakdown. For example, if your boiler breaks down and leaks, damaging the area around it, the insurance may cover that damage.

The insurance will often not cover the actual boiler replacement or repair unless you have a separate additional policy, but it will cover the resulting damage to your home.

What Is Boiler Cover?

Boiler cover is a type of insurance that will cover the cost of calling for an engineer who’s trained in gas safety to diagnose your boiler. It also covers the cost of repairs and replacements.

It will pay for the labour, parts, and sometimes the annual service that your boiler needs. There are usually three different options.

Some people choose a boiler-only cover policy, which covers the boiler if it breaks down. It usually does not cover other appliances that work off of your boiler.

You can also choose boiler cover with central heating cover, which will ensure that your boiler and your central heating system are covered. This means that you can get repairs to your pipes or radiators if something goes wrong.

The third type is a more broad type of cover called home emergency cover. It is a good option for people who want to cover anything in their homes, such as the boiler, central heating, plumbing and more.

Are There Exclusions with Boiler Cover?

If you get boiler cover, you will find that they often exclude boilers by their age. If your boiler is more than 15 years old, it is likely to be excluded, but it could also be excluded if newer, depending on the circumstances.

They also have exclusions for boilers in particular types of property, such as mobile homes, bedsits, or commercial properties, and they may require you to prove that you have maintained your boiler.

Another common condition is that they may not allow you to make your claim within a month of taking out the policy. You may not be able to get a policy the day that your boiler has a breakdown and then make a claim.

It is always a good idea to read through any paperwork, as there may be limits on how much it covers, how often you can make a claim, and more.

Who Would Benefit From Boiler Cover?

If you own your home, then you can benefit from boiler cover as long as you ensure that your boiler is eligible. People who rent typically aren’t responsible for the boiler, so they don’t need to worry about it.

Some people prefer to get this type of cover, while others prefer to save the money in a home emergency savings account. The most important thing is to make sure that you know where you stand and what options are available to you.

It can be expensive to have a sudden breakdown, and if you aren’t covered, you need to make sure that you can afford to replace your boiler. If not, you might want to consider this type of policy.

What Is Home Emergency Cover?

Some people see home emergency cover as a type of boiler cover. However, it covers much more than your boiler and can be a good idea.

Usually, you can add this type of policy to your existing home insurance policy. It can protect you from costs of repairs for large appliances that are not in your policy.

Home emergency cover is most often used in situations where your home loses its primary source of light, water, or heat. This can include an electrical supply failure, loss of water or heat, issues with your roof, or more.

This type of cover doesn’t include maintenance or standard servicing, but it covers unexpected emergencies such as your boiler breaking down. It will cover costs for calling out a technician and making a repair.

Home emergency cover takes care of more than just the boiler, including burst pipes, electrical failures, plumbing issues, and more.

Some issues are not covered, like an issue that occurs as the result of neglect or an issue that you knew about before your policy took effect.

They may not cover a home that is left empty for more than 60 days, and they don’t cover damage from maintenance or repairs.

How Often Should a Boiler Be Serviced?

Whether you own your home or you are a landlord who owns a rental, you need to service your boiler every twelve months. If you don’t, you can experience a boiler breakdown, and it always seems to happen at the worst possible time.

If you are a landlord, you should know that it is a legal requirement to have your boiler serviced once every twelve months. Even if it hasn’t been a year, there are signs that your boiler needs servicing, such as noisiness, no water, leaks, bad smells, or water taking too long to heat up.

Conclusion

Although home insurance does not usually cover boiler breakdowns, there are other types of cover that you might be able to get. Boilers always seem to break down at the worst possible time, so this is a great option.